Shop today,

enjoy tonight.

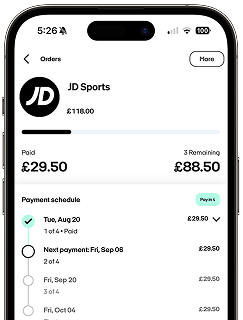

From new power tools to a fresh wardrobe, Clearpay lets you shop in-person and split the payments. Just set up the digital Clearpay Card and start tackling your list.

Set up Clearpay Card

Clearpay is unregulated credit. Please use responsibly. T&Cs, late fees of up to £24 per purchase apply

How it works

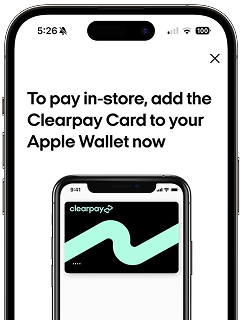

Download Clearpay Card.

Get the Clearpay app. Go to the In-Store tab to set up the digital Clearpay Card, and follow the prompts to add it to your phone’s wallet.

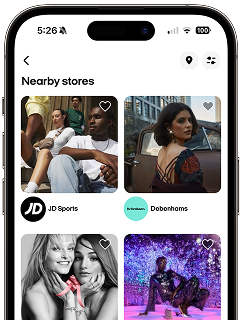

Find nearby stores.

Browse the In-Store tab to find shops near you that accept Clearpay in-person.

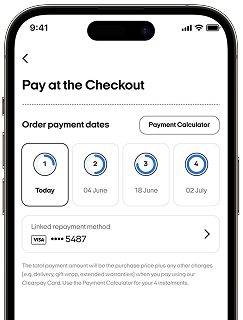

Pre-authorise the payment.

Before you pay, pre-approve your purchase amount in the app.

Tap to pay & get it today.

You can Clearpay with Apple Pay, Google Pay or Samsung Pay.

Where it works

From electronics to essentials, duvets to designer shoes, Clearpay Card is your key to getting what you need in-store.

Beauty

Mechanics

Fashion

Pets

Homewares

Home & Garden

The same Clearpay perks you love, but in-store.

Frequently Asked Questions

How do in-store purchases work with Clearpay?

How do I know where I can shop?

Is there a minimum spend for in-store Clearpay purchases? Is there a maximum spend?

Can I use the Clearpay Card with Apple Pay for online purchases?

- Launch the Clearpay app and tap the ‘Card’ tab to see the estimated amount you have available to spend

- Tap the ‘Authorise and pay in-store’ button to initiate the payment process and then tap ‘Pay in-store with Apple Pay’’ to authorise and launch the Clearpay Card in your digital wallet.

- In the merchant's app or website, select Apple Pay at checkout.

- Select the Clearpay Card, review your purchase details, and then confirm with Face ID, Touch ID or your device passcode.

Do I have to download the Clearpay app to use Clearpay in-store?

How do I return something I purchased in-store using Clearpay?

- Launch the Clearpay app and tap the In-Store tab.

- Select “How it Works” in the top right-hand corner, followed by “How do I return an order?”.

- Tap the “Make a Clearpay Card return” button, followed by “Refund to Clearpay Card”.

- The Clearpay Card will open in your digital wallet.

- Tap the phone near the card reader to initiate the return.

- The refund will go back to the Clearpay Card.

Where can I see my past in-store Clearpay purchases?

I’m a retailer. How do I offer Clearpay in my stores?

Mechanics

Fashion

Pets

Homewares

Home & Garden

Beauty