ONLY IN THE APP

Unlock the world’s

top brands.

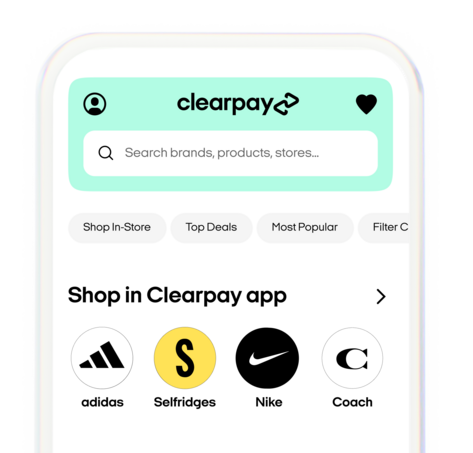

Nike

adidas

Selfridges

Coach

Pay it in 4 at more of your favourite brands.

Just download the Clearpay app to start shopping.

Pay it in 4 at more of your favourite brands. Just download the Clearpay app to start shopping.

Head’s up, Clearpay may earn a commission if you purchase with us.

Clearpay is unregulated credit. Please use responsibly. T&C and late fees up to £24 per purchase apply.

Head’s up, Clearpay may earn a commission if you purchase with us. Clearpay is unregulated credit. Please use responsibly. T&C and late fees up to £24 per purchase apply.

How it works.

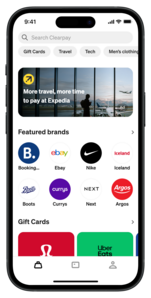

You can only Clearpay these brands in the app.

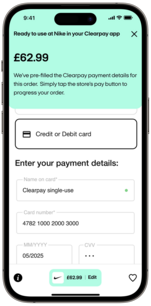

We’ll issue a one-time card so you can complete your order.

1

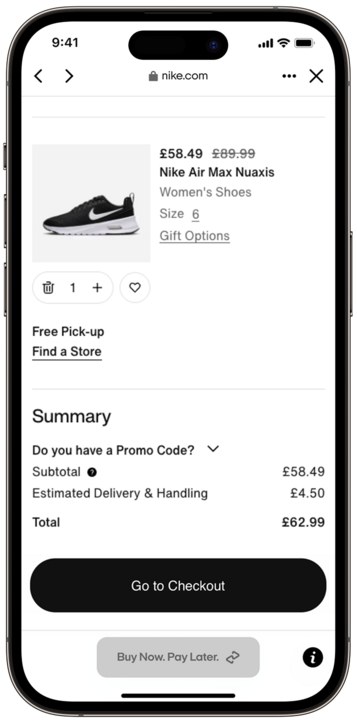

Shop your favourite brands

Explore app-only brands in the Shop in Clearpay app section in the Shop tab.

2

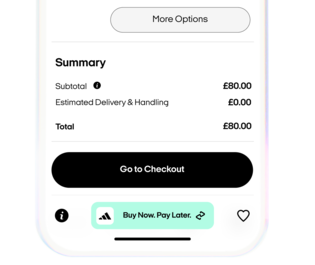

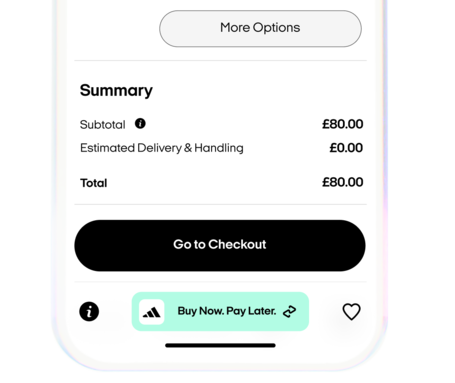

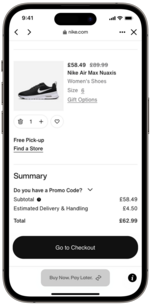

Check out with Clearpay

Select Credit or Debit card, then tap the Buy Now. Pay Later button. Confirm your order amount and payment schedule.

3

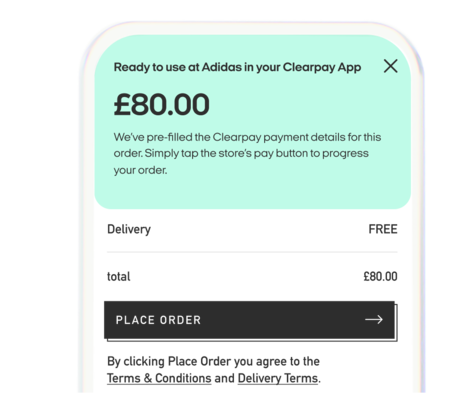

Complete your purchase

Clearpay lends you a fixed amount of credit so you can pay for your purchase over 4 instalments, due every 2 weeks. Ensure you can make repayments on time. You must be 18+ and a permanent UK resident (excl Channel Islands). Clearpay charges a £6 late fee for each late instalment and a further £6 if it’s still unpaid 7 days later. Late fees are capped at £6 for orders under £24 and the lower of £24 or 25% of the order value for orders over £24. Missed payments may affect your ability to use Clearpay in the future and your details may be passed onto a debt collection agency working on Clearpay's behalf. Clearpay is credit that is not regulated by the Financial Conduct Authority. T&Cs and other eligibility criteria apply at clearpay.co.uk/terms

Frequently Asked Questions

Open your Clearpay app (or download the app and sign up if you haven’t already). Find a merchant in the Shop in Clear app section or any merchant marked “In-App Only.” Shop as you would any other merchant in the app, add items to your cart, and when you’re ready to check out, tap the “Buy Now. Pay Later” button at the bottom of the screen and follow the instructions.

You can see your Pay in 4 available spend in the My Clearpay tab in the Clearpay app.

Open the Clearpay app and click on the Shop tab. Find the section labeled “Shop in Clearpay app” and click on the black arrow on the right to see the full list of merchants that are available only in the Clearpay app.

If your item is eligible for a refund to your original form of payment, follow these steps:

- Complete the merchant’s returns process before starting the Clearpay returns process.

- In the My Clearpay tab, select the order you wish to return

- Tap the “...” menu button, then select Returning an order

- Select Returning by mail

- Follow the remaining steps.

- If you have a question or a concern regarding your refund, please contact Clearpay’s customer support team and include a copy of your refund receipt or proof of refund in your message.

You can view and manage your purchases in the My Clearpay tab from in the Clearpay app.

Please check that you entered the right purchase amount, including any taxes and shipping costs. Then try again by tapping “Buy now. Pay Later” at checkout and entering your updated purchase amount. If you've already entered a purchase amount and you need to edit it, tap the Clearpay button at the bottom of the screen and select “Edit Card Amount.”

If you’re using store credit, a promo code or a gift card, read How do I use Single-Use payment with store credit, promo codes or gift cards?

Please note: You're only charged for what you end up spending, so don't worry if the purchase amount is slightly larger than your order.

We add a small buffer amount at certain merchants to allow for extra tax/shipping charges from the store, which prevents order declines. For example, if your final checkout screen shows £100 but your actual order was for £90, we’ll wait until the merchant confirms the final order total and then will void the £10 difference. You WILL NOT be charged for the difference; only for the actual final order total from the merchant.

We personalise your app experience, which means we occasionally switch up the brands you see to ensure they’re relevant to you.

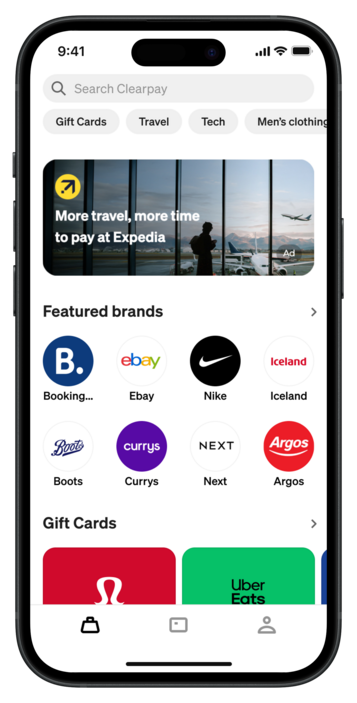

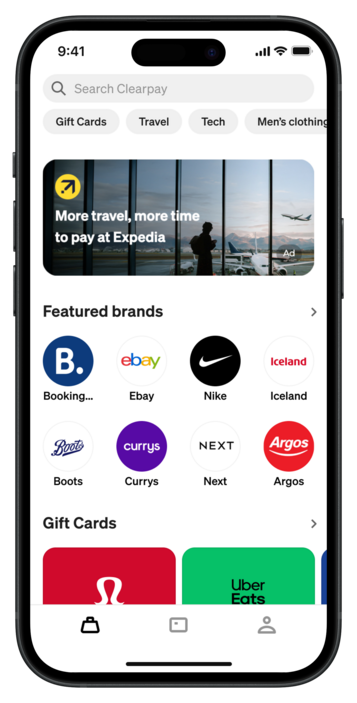

Unlock more brands in the app

Shop conveniently through the Clearpay app for brands

you can't Clearpay anywhere else.

Shop conveniently through the Clearpay app for brands you can't Clearpay anywhere else.

Head’s up, Clearpay will earn a commission if you purchase with us. Clearpay is unregulated credit. Please use responsibly. T&C and late fees up to £24 per purchase apply.

How it Works

When you shop one of our app-exclusive brands, we’ll issue you a single-use payment card at checkout so you can complete your order.

Step 1

Shop your favourite brands

Explore app-only brands in the 'Featured brands' section in the Shop tab.

Step 2

Select payment method

Select Credit or Debit card, then tap the 'Buy Now. Pay Later' button. Confirm your order amount and payment schedule.

Step 3

Place your order and you’re all set!

A one-time card will autofill into the credit/debit card section.

Note: Sometimes we add a small buffer to allow for extra shipping charges or tax. This helps prevent order declines. Once your purchase is confirmed, the extra charge is automatically cancelled and will not appear in your final repayment. We'll only charge you for what you spend. Your payment plan will be updated automatically to reflect the final order amount.

Step 1

Shop your favourite brands

Explore app-only brands in the 'Featured brands' section in the Shop tab.

Step 2

Select payment method

Select Credit or Debit card, then tap the 'Buy Now. Pay Later' button. Confirm your order amount and payment schedule.

Step 3

Place your order and you’re all set!

A one-time card will autofill into the credit/debit card section.

Clearpay lends you a fixed amount of credit so you can pay for your purchase over 4 instalments, due every 2 weeks. Ensure you can make repayments on time. You must be 18+ and a permanent UK resident (excl Channel Islands). Clearpay charges a £6 late fee for each late instalment and a further £6 if it’s still unpaid 7 days later. Late fees are capped at £6 for orders under £24 and the lower of £24 or 25% of the order value for orders over £24. Missed payments may affect your ability to use Clearpay in the future and your details may be passed onto a debt collection agency working on Clearpay's behalf. Clearpay is credit that is not regulated by the Financial Conduct Authority. T&Cs and other eligibility criteria apply at clearpay.co.uk/terms

Unclear on anything?

How can I use Clearpay at these new merchants?

Select Credit or Debit card, then tap the “Buy Now. Pay Later” button. Confirm your order amount and payment schedule.

How do I know how much I can spend?

You can see your Pay in 4 available spend in the My Clearpay tab in the Clearpay app.

Where do I find app-exclusive brands in the app?

How do I return something purchased at an “In-App Only” merchant?

If your item is eligible for a refund to your original form of payment, follow these steps:

- Complete the merchant’s returns process before starting the Clearpay returns process.

- In the My Clearpay tab, select the order you wish to return

- Tap the “...” menu button, then select Returning an order

- Select Returning by mail

- Follow the remaining steps.

- If you have a question or a concern regarding your refund, please contact Clearpay’s customer support team and include a copy of your refund receipt or proof of refund in your message.

Where can I see my purchases/orders?

Why was my order declined when I had available funds?

If you’re using store credit, a promo code or a gift card, read How do I use Single-Use Payment with store credit, promo codes or gift cards?

Why is the amount shown on the final checkout screen different from the purchase amount I entered?

We may add a small buffer amount to allow for extra tax/shipping charges from the store, which prevents order declines.

You WILL NOT be charged for the difference; only for the actual final order total from the merchant.

For example, if your final checkout screen shows £100 but your actual order was for £90, we’ll wait until the merchant confirms the final order total and then will void the £10 difference from your last instalment.

Why don't I see some merchants but someone else does? Why did I see some merchants and now I don't?

We personalise your app experience, so the brands and merchants you see may differ from those shown to other customers. Merchant availability can also depend on your eligibility and shopping preferences, so you may notice certain merchants appear or disappear over time.

Do I have to download the Afterpay app to use Afterpay in-store?

How do I know how much I can spend?

What are the benefits of choosing a payment day?

How do I return something purchased at an “In-App Only” merchant?

If your item is eligible for a refund to your original form of payment, follow these steps:

- Complete the merchant’s returns process before starting the Clearpay returns process.

- In the My Clearpay tab, select the order you wish to return

- Tap the “...” menu button, then select Returning an order

- Select Returning by mail

- Follow the remaining steps.

- If you have a question or a concern regarding your refund, please contact Clearpay’s customer support team and include a copy of your refund receipt or proof of refund in your message.

Is there a limit on changing my preferred payment day?

Why was my order declined when I had available funds?

If you’re using store credit, a promo code or a gift card, read How do I use Single-Use Payment with store credit, promo codes or gift cards?

Is there a limit on changing my preferred payment day?

Why don't I see some merchants but someone else does? Why did I see some merchants and now I don't?

We personalise your app experience, so the brands and merchants you see may differ from those shown to other customers. Merchant availability can also depend on your eligibility and shopping preferences, so you may notice certain merchants appear or disappear over time.